Tax Deadlines

If you miss important tax deadlines like April 15th to file your return or pay estimated quarterly taxes, you can face steep penalties, but you can avoid late fees by filing for extensions or paying what you owe as soon as possible after missing a deadline.

Your Takeaways:

- Important deadlines include: January 15 for 4th quarter estimated payments, January 31 for W-2s and 1099s, April 15th for filing taxes and extensions, IRA contributions, estimated payments.

- If you owe taxes and miss the April 15th deadline, you'll face penalties for late filing and late payment. No penalty if you're owed a refund.

- To avoid late fees, file an extension by April 15th if you need more time. Extensions push deadline to October 15th.

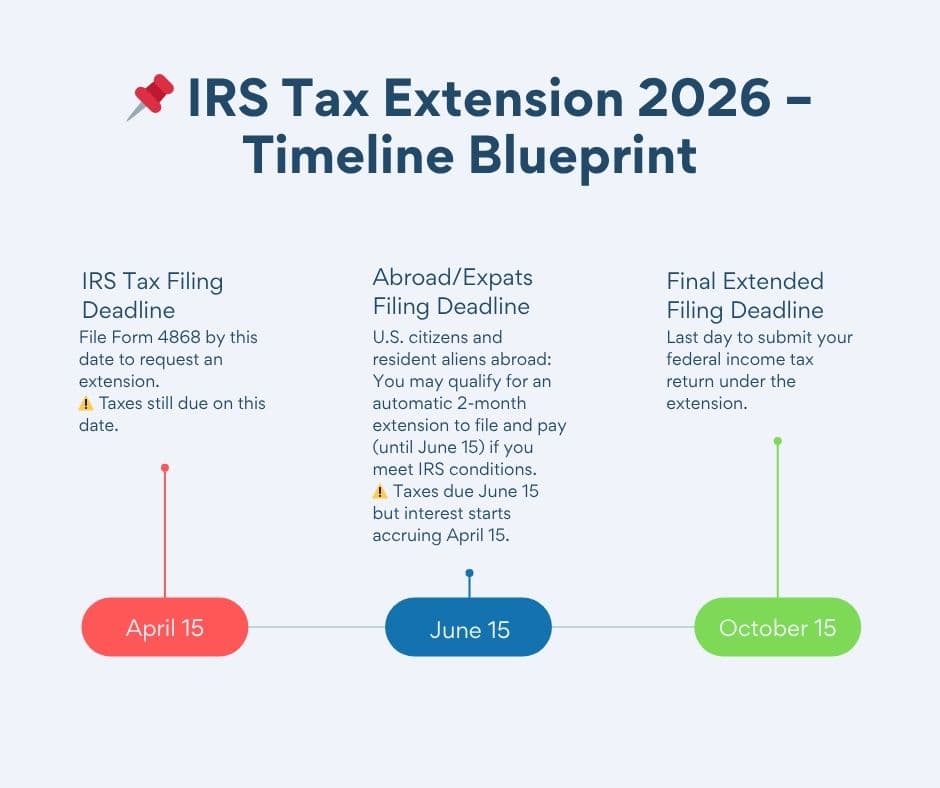

Every year, millions of taxpayers ask: When are taxes due with an extension? The short answer is April 15 to pay and October 15 to file. But it’s not that simple. Missing the details could mean penalties.

This guide covers essential tax deadlines, what happens if you miss them, and how to request an automatic six-month extension to file your federal income tax return. Whether you’re a W-2 employee, a freelancer making estimated tax payments, or a retiree managing required minimum distributions, we’ll make sure you know exactly when to file your income tax return (and when to pay).

Federal Tax Deadlines: Key Dates You Can’t Miss

Most taxpayers' federal income tax deadline is April 15 each year. That’s the last day to file your return or pay any balance due without penalties. However, if the date falls on a legal holiday or weekend, the due date is pushed to the next business day.

In 2026, Tax Day (the IRS’s favorite holiday) lands on Wednesday, April 15. This is the deadline to:

- File your federal tax return (Form 1040 for calendar year filers)

- Make your estimated tax payment for the first quarter of the year

- Contribute to your IRA or HSA for the prior tax year

- File an extension request if you need more time to file

How an IRS Tax Extension Works (and What It Doesn’t Cover)

A tax extension gives you an extra six months to submit your federal income tax return, moving your filing deadline from April 15 to October 15. It’s an automatic extension for a reason. File Form 4868, and you’re in.

An extension buys you more time to file, not more time to pay. Your tax bill is still due April 15. If you don’t pay on time, penalties and interest begin immediately.

When Are Taxes Due With an Extension?

If you submit Form 4868 on time, your tax extension deadline becomes October 15. Think of October 15 as your tax procrastinator’s safety net, but don’t push it too far.

Special Situations

Some taxpayers qualify for automatic extensions without filing Form 4868. Here are the most common cases:

- Combat zone service members – Filing and payment deadlines are extended for at least 180 days after leaving the combat zone, plus any time left in your original filing window. IRS Combat Zone Extension Rules.

- Federally declared disaster areas – If FEMA declares your area a disaster zone and the IRS issues tax relief, filing and payment deadlines may be extended. Always be sure to check the IRS disaster relief announcement for details. IRS Disaster Relief Announcements.

- U.S. citizens, resident aliens, and military on duty outside the U.S. – Qualify for an automatic 2-month extension (to June 15) if they either:

– live outside the United States and Puerto Rico and their main place of business or post of duty is also outside those areas, or

– are in military or naval service on duty outside the United States and Puerto Rico.

Interest on any unpaid taxes still starts accruing after April 15. IRS Extension for Taxpayers Abroad IRS Extension for Taxpayers Abroad.

Bottom line: In these situations, the IRS grants extra time to file and sometimes time to pay without penalties. Most of the time, you don’t need to submit paperwork. The extension is automatic.

2026 Tax Calendar: Full IRS Deadlines for Individuals

Date | Deadline/Event | Notes |

|---|---|---|

Jan 15 | 4th Quarter Estimated Tax Payment | Final payment for the previous year’s taxes. |

Late Jan | IRS Begins Accepting Returns | E-file opens; direct deposit = fastest refunds. |

Jan 31 | W-2s & 1099s Sent | Employers/clients must provide forms. |

Feb 15 | Last Day to Re-File Exemption from Withholding | Update W-4 if you’re exempt. |

Apr 1 | RMD Deadline | For those who turned 73 last year. |

Apr 15 | Tax Day | File return, pay taxes, make 1st quarter estimated payment, IRA/HSA contributions. |

Jun 15 | 2nd Quarter Estimated Payment | Covers income not subject to withholding. |

Sep 15 | 3rd Quarter Estimated Payment | Another installment is due. |

Oct 15 | Extended Tax Return Deadline | If Form 4868 is filed, this is the last day to submit your return. |

Dec 31 | Year-End Tax Moves | RMDs, Roth conversions, donations, and deductible payments. |

Note: If a tax deadline falls on a weekend or legal holiday, the due date will move to the next business day.

IRS Penalties: What Happens if You File or Pay Taxes Late

If you miss the filing deadline and owe taxes:

- Late-filing penalty: 5% of unpaid taxes per month (max 25%)

- Late-payment penalty: 0.5% per month (max 25%)

- The IRS charges daily interest until you pay in full, another reason not to miss the deadline.

If you’re due a tax refund, you won’t be penalized for filing late. You have three years from the tax return due date to claim a tax refund before it becomes the property of the U.S. Treasury.

How to Avoid IRS Penalties

The IRS doesn't wait around if you miss a tax filing deadline and owe money. Penalties and interest start piling up the day your return is due, and they keep adding up until you file and pay what you owe.

If you cannot pay the full amount owed, you should pay what you can to minimize fees and set up a payment plan.

To avoid penalties:

- File early or request an extension electronically by April 15

- Consult a tax preparer or tax professional if you’re unsure

Filing Your State Tax Return

Don’t forget your state tax authority. Most states play copycat with the federal deadline, but a few like to make their own rules. If you need a state extension, you may need to file separately from your federal extension request.

Tax Extensions and Credits: What You Need to Know

Many taxpayers worry that missing the tax filing deadline will automatically disqualify them from valuable tax breaks like the EITC or CTC. The truth is a little more nuanced.

Federal Rules

- Credits – You must file a federal tax return to claim credits like the EITC and CTC. You don’t have to file by April 15, but you must file within the IRS’s three-year window from the original due date to get your tax refund.

- Deductions – You can still claim deductions for student loan interest, qualifying loan fees, charitable contributions, and IRA or HSA contributions when you file your return — even if you filed under an approved extension (by October 15).

If you miss the extension deadline, you can still file later and claim these deductions, but late-filing penalties and interest may apply. You generally have up to three years to claim a refund.

Why Filing On Time Still Matters

If you owe taxes, filing late without an extension can trigger penalties and interest — and delay your refund. While most federal credits and deductions (like the Earned Income Tax Credit or Child Tax Credit) can still be claimed on a late return, you generally have only three years to file before your refund — and any refundable credits — expire.

Some state programs are stricter: to qualify for state-level EITC or child credits, you often need to file on or before the original deadline.

Bottom line: Filing on time protects your refund and keeps every credit on the table. Even if you can’t finish by April 15, filing a valid six-month extension is the safest move.

💡 Tip: If Tax Day is closing in, don’t stress. Just extend. We’ll help you request an extension, file your tax return, and make your tax payment without breaking a sweat.

✅ Skip the stress, ditch the IRS drama, and crush your tax deadline.

Are you filing today, or need an extension? FileTax.com makes it effortless. There are no gimmicks, no gotchas, just peace of mind.

Other Categories

See what some of the hundreds of thousands of satisfied customers have to say about our services:

See what some of the hundreds of thousands of satisfied customers have to say about our services:

Levi C.

VERY FAST

VERY FAST

I got approved within a couple of days for my tax extension filing through these guys, and they responded to my email the same day. Great customer service and fast results. Give them a shot.

LaMontica

Great Service!!

Great Service!!

This is the second year that I have used this service. Each time, the process was quick, easy, and efficient. I will definitely be using this service in the future and will recommend it to friends and family.

Chezbie

Fantastic Site!!

Fantastic Site!!

The process was so easy. I processed this extension in a matter of minutes! For you last-minute filers out there, come here. It'll help you end your long day in peace!

File your tax extension today!

Get StartedFile your tax extension today!

2026 Tax Extension FAQs

2026 Tax Extension FAQs

Extension deadline to file: October 15. Payment deadline: April 15.