How to Fill Out a W-4 if You’re Married and Both Work

Your Takeaways:

- Dual-income couples are at higher risk of under-withholding.

- Each employer withholds as if their job is your only income.

- Checking Step 2(c) on both W-4s helps account for two incomes.

- The IRS Withholding Estimator is the most accurate option.

- Only one spouse should claim dependents on a W-4.

If both spouses work, fill out each W-4 carefully. Check Step 2(c) on both forms or use the IRS Withholding Estimator to avoid under-withholding and surprise tax bills.

This guide walks you through each step of the W-4, showing how to get accurate withholding, use the IRS estimator, and balance your paycheck with your refund.

Definition: Form W-4 tells your employer how much federal income tax to withhold from each paycheck.

Why Dual-Income Couples Need W-4 Adjustments

Two paychecks can distort your federal tax withholding. Employers calculate withholding as if each paycheck were your only income. When both spouses work, this can lead to under-withholding since total household income is higher than either job alone.

1. Each Job Calculates Withholding Separately

Employers use IRS tables based on the income from a single job. But when you both earn money, your household income may fall into a higher tax bracket under the Married Filing Jointly rules.

If one spouse earns $60,000 and the other earns $50,000, your combined $110,000 for 2026 still falls within the 22% tax bracket for Married Filing Jointly, which applies to taxable income up to $211,400.

However, the problem isn’t your top tax rate—it’s that your employers don’t see the full $110,000 household income. Each employer withholds too little because they think you qualify for the full standard deduction and lower tax bands separately.

That difference adds up over the year and can leave you short on withheld tax.

Sources:

2. The Standard Deduction Is Applied Twice

Each W-4 assumes you’ll claim the standard deduction ($32,200 for 2026) if you’re filing Married Filing Jointly. Because both employers apply this assumption, your household could under-withhold if both W-4s treat it separately.

At tax time, the IRS recalculates your total taxable income using only one standard deduction, and that’s when couples often see a bill they didn’t expect.

Other Factors That Distort Withholding

Even if your income and W-4 entries seem straightforward, a few hidden factors can still throw off your federal income tax withholding:

- Credit and deduction phaseouts – As your combined household income rises, some tax benefits—like the Child Tax Credit (CTC), education credits, and student loan interest deduction—begin to phase out. If your W-4 doesn’t reflect these limits, your withholding may be too low.

- Uneven pay or bonuses – When one spouse earns bonuses or variable income, the default 22% supplemental rate might not match your true tax bracket. Use the IRS Withholding Estimator or Multiple Jobs Worksheet to fine-tune your entries.

- Inflation and bracket creep – Even modest raises can nudge part of your income into a higher tax bracket over time. Reviewing your W-4 each year helps prevent under-withholding caused by bracket creep.

💡 Pro Tip: Revisit your W-4 anytime your household income changes. Small adjustments made throughout the year can help prevent a large balance due at tax time.

How to Stay Accurate

Follow these W-4 tips for married couples to stay accurate:

- Use the IRS Withholding Estimator to enter both spouses’ jobs and total income.

- If there are only two jobs total, both spouses can check the box in Step 2(c) on Form W-4.

- If your incomes differ significantly, have the spouse with the higher-paying job complete Steps 2–4 more thoroughly.

- Add a small extra withholding amount on line 4(c) if your joint earnings are near the next bracket threshold.

- Recheck your pay stubs every few pay periods to confirm that enough federal income tax is being withheld.

By fine-tuning your W-4s together, you’ll have more accurate withholding, predictable paychecks, and fewer tax-time surprises.

📘 Source: IRS Publication 505

🔗 Related Topic: Single vs Married Tax Withholding

Step-by-Step Guide: How Married Couples Should Fill Out the W-4

The W-4 form is straightforward once you know what each step means. Here’s your W-4 step-by-step walkthrough for married couples who both work.

Here’s a joint W-4 filing guide for two incomes.

Step 1 – Enter Personal Information

- Choose your filing status:

- Single or Married filing separately

- Married filing jointly or Qualifying surviving spouse

- Head of household (if you qualify)

- Married couples filing jointly should typically check “Married filing jointly.”

- If you want slightly higher withholding (to avoid owing), you can select “Single or Married filing separately” instead.

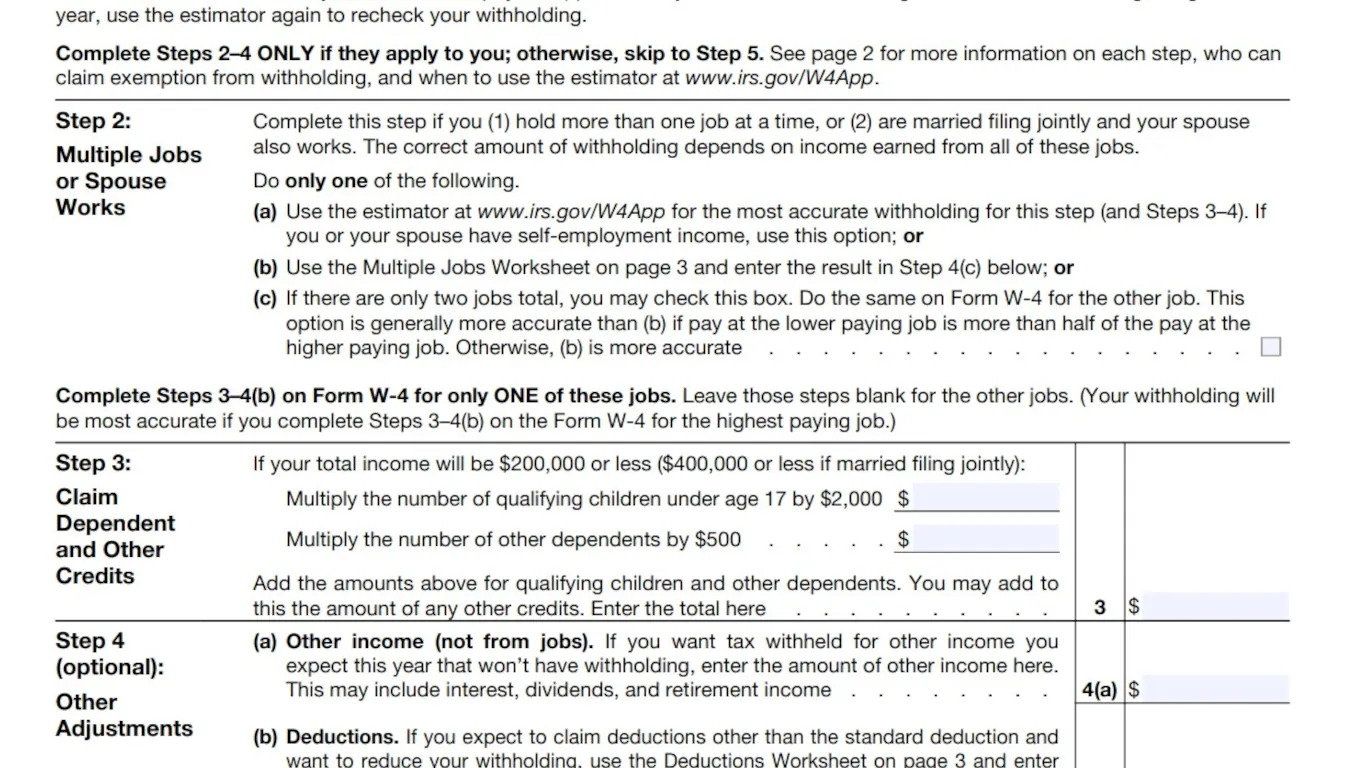

Step 2 – Multiple Jobs or Spouse Works

This step is crucial for dual-income couples.

- If both spouses have jobs—or one person has more than one job—you must complete this section accurately.

- Choose one of three ways:

- Use the IRS Tax Withholding Estimator (most accurate).

- Use the Multiple Jobs Worksheet on page 3.

- If there are only two jobs in total, check the box in Step 2(c) on both W-4s.

Step 3 – Claim Dependents

Combine all eligible dependents on one spouse’s W-4 to avoid duplication.

If you qualify for child-related tax credits, calculate the total credit and list it on one form only.

Step 4 – Other Adjustments (Optional)

Use this section to customize your withholding amount:

- 4(a) – Add other income not subject to withholding (e.g., interest, dividends, side-gig income).

- 4(b) – Add deductions beyond the standard deduction (mortgage interest, medical expenses, student loan interest).

- 4(c) – Enter an additional flat dollar amount if you want extra withholding for more accuracy or a bigger refund.

Step 5 – Sign and Submit

Sign, date, and hand it to your HR or payroll team. Review your first wage and tax statement after one pay period to confirm that the federal tax withheld matches expectations.

Source: IRS Form W-4

Tips to Avoid Under-Withholding When Both Spouses Work

Even if you fill out your W-4 correctly, dual-income couples can still under-withhold—especially when both earn similar amounts. The IRS system doesn’t automatically combine two jobs, so use these strategies for correct withholding.

Here’s how to get the correct tax withholding when you and your spouse both work.

1. Check the Box in Step 2(c) on Both W-4s

This is the IRS’s preferred method for two-earner couples.

If there are exactly two jobs total in your household (one per spouse), both should check Step 2(c) — the box labeled “Multiple Jobs or Spouse Works.”

When both spouses do this:

- Each employer increases federal income tax withholding slightly to account for your combined household income.

- The system automatically adjusts your married filing jointly withholding closer to what you’ll actually owe.

- It eliminates the need to “trick” the system by marking one W-4 as “Single.”

💡 Bottom line: Checking Step 2(c) on both forms is the simplest way to get accurate tax withholding for dual earners.

2. Use the IRS Withholding Estimator for Precision

If your income levels differ significantly or one spouse has more than one job, use the IRS Tax Withholding Estimator.

It factors in all jobs, income types, dependents, and credits, and shows exactly what to enter in Step 4(c) for optional extra withholding.

🔗 Related Topic: How to Calculate Federal Income Tax for Married Filing Jointly

3. Avoid Double-Claiming Dependents

If you have qualifying children or other dependents, only one spouse should claim them in Step 3 of the W-4.

Listing the same dependents twice can result in withholding too much and may cause a surprise balance due when filing jointly.

Let one spouse claim all dependents; the other can add a small amount in Step 4(c) to even things out.

4. Adjust for Bonuses or Variable Income

For 2026, employers generally withhold a 22% flat rate on bonuses and other supplemental wages. Depending on your total income, your actual effective rate may be higher.

You can correct this by:

- Asking HR to apply a higher percentage to bonuses, or

- Enter an extra flat dollar amount in Step 4(c) for ongoing paychecks.

Source: IRS Pub. 15-T, Supplemental Wages

🔗 Related Topic: Marginal Tax Rate for Married Filing Jointly

5. Recalculate After Life or Job Changes

You can update your W-4 at any time—not just during tax season.

Submit a new one when you:

- Start or change jobs

- Receive a raise or bonus

- Have a child or gain new dependents

- Begin earning self-employment income or retirement income

These updates help keep your withholding amount aligned with your real-world tax liability.

Example: Two Incomes, One Tax Return

Let’s see how small W-4 choices can dramatically change your results if you and your spouse both work.

Spouse A Income | Spouse B Income | W-4 Step 2 Setting | Approx. Combined Withholding | Result at Tax Time |

|---|---|---|---|---|

$60,000 | $40,000 | Both leave Step 2 unchecked | ≈ $3,600 | ≈ $4,143 tax due |

$60,000 | $40,000 | Both check Step 2(c): “Multiple Jobs or Spouse Works” | ≈ $7,500 | ≈ $243 tax due |

Note: Based on 2025 standard deduction and brackets

How Step 2(c) Fixes the Problem

- The Step 2(c) checkbox tells both employers that your household has two jobs total.

- Each employer then withholds slightly more federal income tax, automatically adjusting for your combined household income.

- This replaces the old “Married but withhold at higher Single rate” checkbox that the IRS removed from the form.

- The result: accurate tax withholding and no surprise bill next April.

When to Use Step 2(c)

✔ Use it if there are exactly two jobs total between you and your spouse.

🚫 If there are more than two jobs, don’t check the box — instead:

- Complete the Multiple Jobs Worksheet on page 3 of Form W-4, or

- Use the IRS Withholding Estimator for precise results.

💡 Pro Tip: Re-run the estimator any time your income changes to keep your married filing jointly withholding on track.

📘 Source: IRS Form W-4

Get the Most Accurate W-4 Withholding When Both Spouses Work

For married couples with two incomes, teamwork and a little W-4 strategy go a long way. When both spouses check Step 2(c), your withholding aligns with your combined income and helps avoid tax surprises.

💡 Pro Tip: If you recently got married or switched jobs, review both of your W-4s side by side. A quick check today could save you from a big bill—or a smaller refund—next year.

H3: Take the Guesswork Out of Your W-4

💡 Use the IRS W-4 Estimator to see exactly how each spouse’s income affects your withholding.

With just a few clicks, you’ll get a custom breakdown showing how to adjust your W-4s for correct tax withholding—and peace of mind when tax season rolls around.

Other Categories

See what some of the hundreds of thousands of satisfied customers have to say about our services:

See what some of the hundreds of thousands of satisfied customers have to say about our services:

Levi C.

VERY FAST

VERY FAST

I got approved within a couple of days for my tax extension filing through these guys, and they responded to my email the same day. Great customer service and fast results. Give them a shot.

LaMontica

Great Service!!

Great Service!!

This is the second year that I have used this service. Each time, the process was quick, easy, and efficient. I will definitely be using this service in the future and will recommend it to friends and family.

Chezbie

Fantastic Site!!

Fantastic Site!!

The process was so easy. I processed this extension in a matter of minutes! For you last-minute filers out there, come here. It'll help you end your long day in peace!

File your tax extension today!

Get StartedFile your tax extension today!

Frequently Asked Questions

Frequently Asked Questions

Yes. Each employer must have its own W-4 based on that person’s job and income.