How to File Taxes Without a W-2

Your Takeaways:

- A missing or delayed W-2 doesn’t mean you can’t file your taxes—you still have options.

- Employers are required to send W-2 forms by January 31, so always contact them first.

- If your employer doesn’t respond, the IRS can help by contacting them or providing a wage and income transcript.

- Your final pay stub can be used to estimate wages and withholdings if needed.

- Form 4852 acts as a substitute W-2 when all other options fail.

If your W-2 is missing or delayed, start by contacting your employer. If it still hasn’t arrived by February 2, 2026, the IRS can step in. As a last resort, you can file using Form 4852 (Substitute W-2).

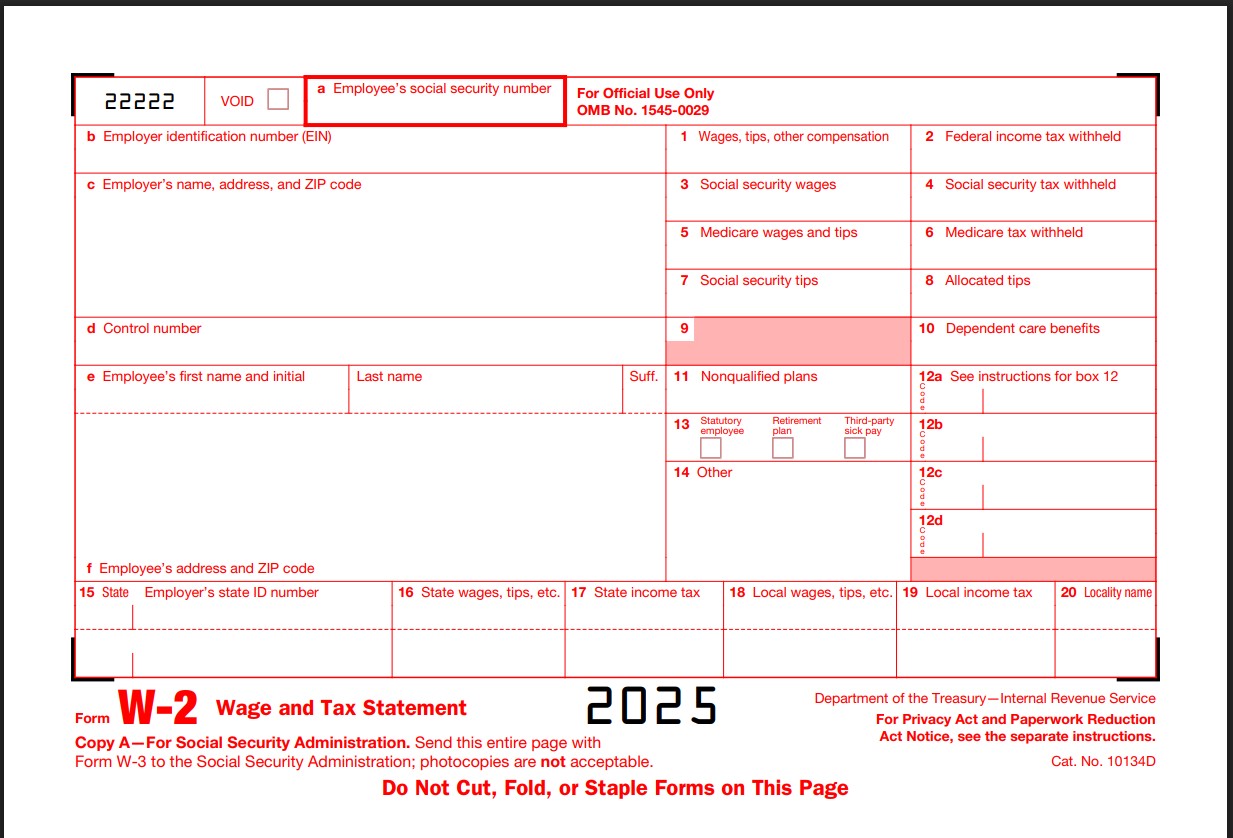

Why a W-2 Form Is Essential for Filing Taxes

The W-2 form is essential for filing taxes. It reports your total wages, federal and state taxes withheld, and your employer’s details.

Without it, the IRS cannot confirm your income or withholding, which may lead to delays, penalties, or errors in your return.

If you’re classified as an independent contractor, you won’t receive a W-2—you’ll get a Form 1099-NEC instead. Students with mixed income types should check out our Forms Guide for Students. But if you’re an employee, you must track down a missing or corrected W-2.

Step 1 – Contact Your Employer

By law, employers must send your W-2 by January 31. If it’s lost, missing, or incorrect, contact them directly with the following options:

- Log in to your HR or payroll portal to download it.

- Send a letter requesting a copy of the missing form.

- Call your employer’s payroll or HR department.

👉 If your W-2 information differs from your pay stubs, ask for a corrected form (Form W-2c). Filing with incorrect information can create IRS mismatches and force you to file an amended return later.

Step 2 – What to Do If the IRS Has to Step In

If your W-2 still hasn’t arrived by the end of February, call the IRS at 800-829-1040. They can:

- Reach out to your employer.

- Provide a wage and income transcript with the data reported.

To speed things up, have the following information ready:

- Your name, address, and Social Security number.

- Your employer’s name, address, and phone number.

- The tax year you’re filing for.

- An estimate of total wages earned and taxes withheld (your pay stub can help here).

- The dates when you worked for the employer.

Step 3 – Use Your Final Pay Stub to Estimate

If your employer is unresponsive and IRS processing takes time, your final pay stub becomes your best tool.

It usually lists:

- Total wages for the year.

- Taxes withheld for federal and state.

⚠️ Note: A pay stub doesn’t always include certain benefits, adjustments, or employer contributions. That means your numbers may differ slightly from what was reported to the IRS.

Keep copies of:

- Your pay stubs.

- Any letters or emails to your employer.

- IRS transcripts or notes from phone calls.

That way, if you later need to amend your return, you’ll have the records to back it up.

For new filers, our First Return page explains what documents to keep on hand.

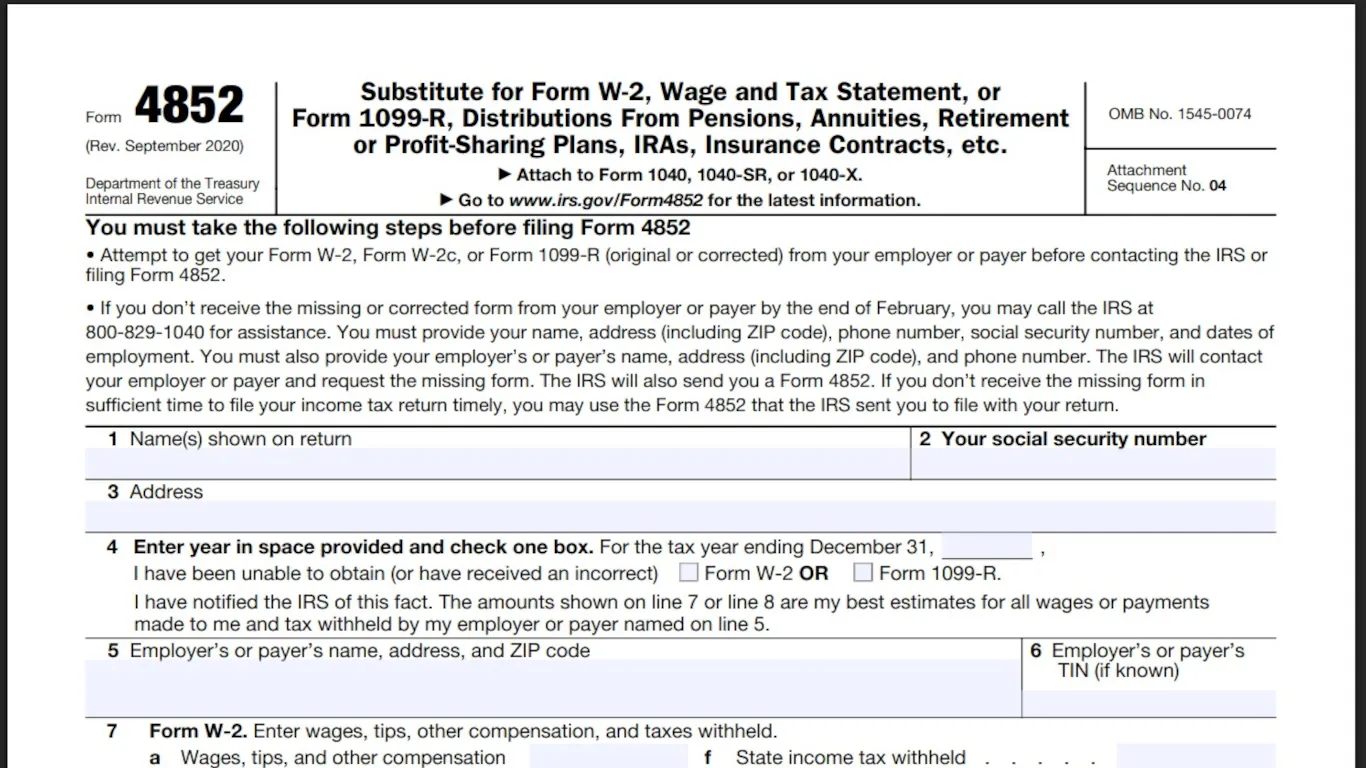

Step 4 – Using Form 4852 as a Substitute W-2

If all else fails, you can file your tax return using Form 4852, the IRS substitute for a missing W-2.

Form 4852 lets you file without a W-2 using estimated wages and withholdings from your pay stub. You should attach it to your return. Do note that it often causes refund delays because the IRS reviews it more closely.

👉 Download it here: IRS Form 4852

Pro tips:

- Always keep a copy of Form 4852 and your supporting documents.

- If you later receive the missing or corrected W-2, you may need to file an amended return using Form 1040-X.

Filing Your Tax Return Without a W-2

Once you’ve gathered your documents, you’re ready to file your tax return.

Options:

- If you get your W-2 late → File normally (e-file).

- If you use Form 4852 → Mail a paper return.

Remember:

- Double-check your wages and taxes withheld before submitting.

- Keep all documentation in case the IRS requests verification.

- If your employer later sends you a corrected form, you may need to amend your return.

Common Issues & Fixes

Incorrect W-2

→ Ask your employer for a corrected form (W-2c). If you’ve already filed, you must submit an amended return (Form 1040-X).

Lost W-2

→ Use your wage and income transcript plus final pay stubs to complete Form 4852.

Employer won’t cooperate

→ Contact the IRS. An IRS representative can follow up with your employer and provide the next steps.

Independent contractor confusion

→ Double-check your classification. Employees get W-2 forms; independent contractors get 1099s.

The Smart Way to File Taxes Without a W-2

Filing taxes without a W-2 is stressful, but you have options. Follow the steps—contact your employer, use IRS support, and file with Form 4852 if needed.

Remember — if you later receive a corrected or late W-2, you may need to file an amended return using Form 1040-X.

To ensure you’re covering everything, visit our First Time Filer Guide for a complete review.

📘Download our Missing W-2 Guide for step-by-step instructions, templates, and contact scripts.

Other Categories

See what some of the hundreds of thousands of satisfied customers have to say about our services:

See what some of the hundreds of thousands of satisfied customers have to say about our services:

Levi C.

VERY FAST

VERY FAST

I got approved within a couple of days for my tax extension filing through these guys, and they responded to my email the same day. Great customer service and fast results. Give them a shot.

LaMontica

Great Service!!

Great Service!!

This is the second year that I have used this service. Each time, the process was quick, easy, and efficient. I will definitely be using this service in the future and will recommend it to friends and family.

Chezbie

Fantastic Site!!

Fantastic Site!!

The process was so easy. I processed this extension in a matter of minutes! For you last-minute filers out there, come here. It'll help you end your long day in peace!

File your tax extension today!

Get StartedFile your tax extension today!

FAQs – Filing Taxes Without a W-2

FAQs – Filing Taxes Without a W-2

Call the IRS after mid-February. They’ll either request it from your employer or help you file with Form 4852.