Should I Claim 1 or 0 if I’m Married?

Your Takeaways:

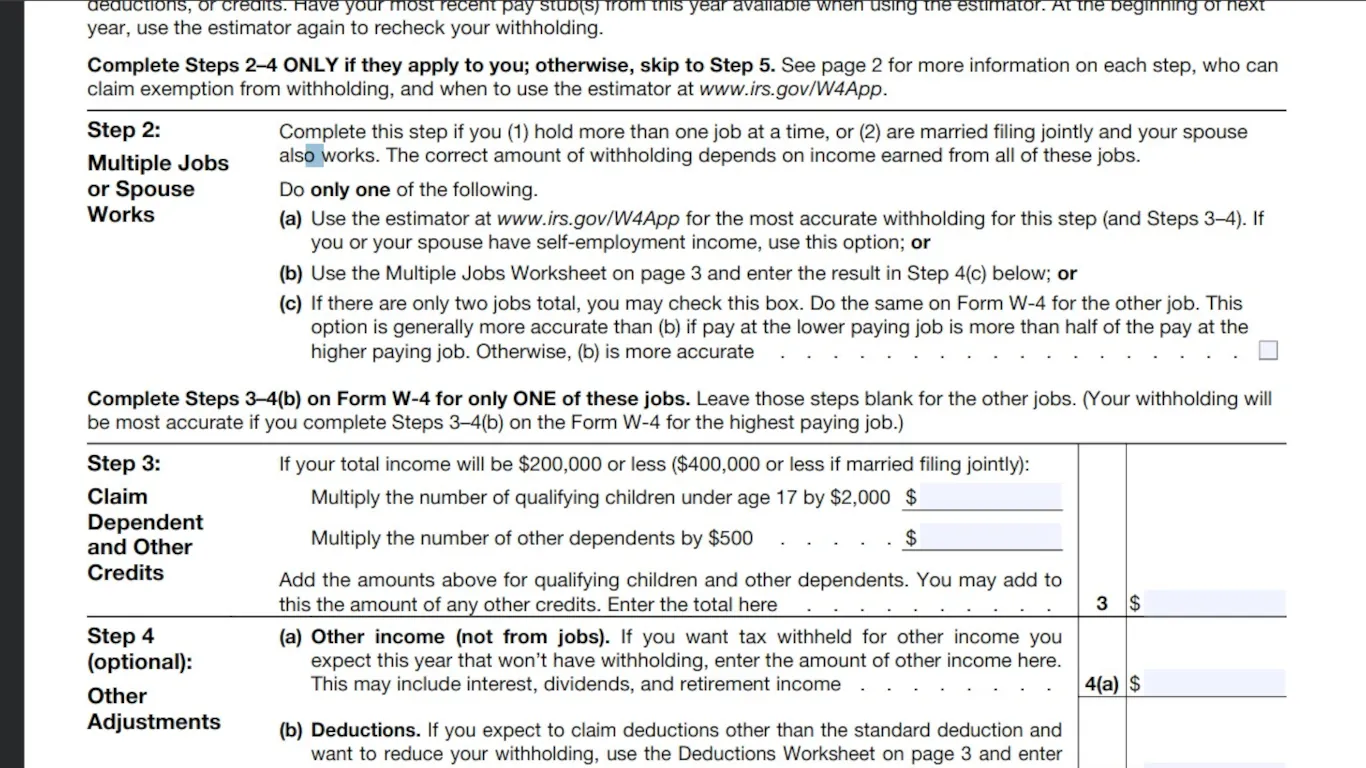

- You can’t claim “1” or “0” anymore — the IRS eliminated W-4 allowances starting in 2020.

- Married couples now set withholding using Steps 2–4 on Form W-4, not allowance numbers.

- If both spouses work, completing Step 2 (Multiple Jobs) helps prevent under-withholding.

- Dependents are claimed in Step 3, replacing the old allowance system.

- Adding money on Line 4(c) creates the same effect as “claiming 0” by increasing withholding.

If you’re asking, “Should I claim 1 or 0 if I’m married?” You can no longer claim ‘1’ or ‘0’ on Form W-4 because the IRS replaced allowances with income and dependent entries starting in 2020. Married couples should use Steps 2–4 on the 2025 Form W-4 to set accurate federal withholding.

To learn how joint filing affects your overall tax situation, see our complete guide on Married Filing Jointly.

This article breaks down what that old system meant, how the new W-4 works, and how to fine-tune your withholding so you get the right refund (and no surprise tax bill) next tax season.

What “Claiming 1 or 0” Meant on the Old W-4

Before 2020, every employee filled out a paper Form W-4, also known as the Employee’s Withholding Allowance Certificate. This tax form told your employer how much federal income tax to withhold from your paycheck each pay period. The more allowances you claimed, the less tax your employer withheld. The fewer allowances, the more your employer sends to the IRS.

Here’s how it worked in plain English:

- Claiming “0” meant you wanted more taxes withheld. Your employer sent a larger portion of each paycheck to the IRS, so your take-home pay was smaller, but you’d usually get a larger tax refund at tax time. This setting was common for people who didn’t want to risk an unexpected tax bill in April.

- Claiming “1” meant you wanted less tax withheld. You kept more money in each paycheck throughout the year, but your refund would be smaller—or you might owe the IRS when you filed your tax return.

- Some taxpayers even claimed more allowances (such as “2” or “3”) if they had qualifying dependents or itemized deductions, as this resulted in a lower taxable income.

It was basically a guessing game. People often ask, “How many allowances should I claim?” without realizing how their filing status, income, and deductions actually affect the math. Many married taxpayers used to compare options like:

Allowances Claimed | Result | Common Outcome |

|---|---|---|

0 | Withhold more tax | Bigger refund, smaller paycheck |

1 | Withhold less tax | Smaller refund, risk of balance due |

2+ | Withhold even less | Higher take-home pay, possible underpayment |

Why the IRS Eliminated Allowances

In 2020, the IRS redesigned the W-4 to make withholding more accurate and transparent. The old allowance worksheet relied on outdated exemption rules that disappeared after the Tax Cuts and Jobs Act (TCJA). Under that law, personal exemptions were eliminated, making “allowances” meaningless.

Instead of asking for “allowances,” the new W-4 requests actual financial details, such as tax filing status, income, dependents, and extra withholding, to calculate taxes accurately. This update helps ensure your money withheld aligns with your actual tax liability.

What It Means for Married Taxpayers Today

If you’re married filing jointly, the number you used to “claim” (like 1 or 0) no longer applies. Instead, you’ll manage your withholding accuracy by filling out Steps 2–4 of the current W-4:

- Step 2: Account for both spouses’ jobs.

- Step 3: Claim dependents for Child Tax Credit eligibility.

- Step 4: Add extra withholding if you want a cushion or expect adjustments due to dual income.

This updated W-4 helps married couples accurately match their withholding to their true tax liability, based on their total household income and tax bracket.

Learn more about how your income fits into each tax bracket in our guide to Marginal Tax Rates for Married Filing Jointly.

💡 Quick definition:

“W-4 allowances” used to determine how much federal tax was withheld before the form was redesigned in 2020. They’ve been replaced by dependents, income, and adjustment entries on the new W-4.

Related Topic: Single vs Married Tax Withholding

How to Fill Out the 2025 W-4 if You’re Married

The redesigned Form W-4 (Employee’s Withholding Certificate) no longer asks for “allowances.” Instead, you’ll set your withholding amount using three main steps:

✅ Step 2: Multiple Jobs or Spouse Works

If both spouses work, check the box or use the IRS Withholding Estimator to balance taxes.

✅ Step 3: Claim Dependents

List dependents for credits to reduce withholding and increase take-home pay.

✅ Step 4(c): Add Extra Withholding

Add extra withholding if you want a refund cushion or expect a higher combined income.

Tip: The fewer dependents or adjustments you enter, the more tax gets withheld.

For a detailed walkthrough, see How to Fill Out a W-4 if Married and Both Work.

Sources: IRS Form W-4 | IRS Publication 505

Example: Married Couple W-4 Comparison (Old vs. New)

Let’s examine how the old “claim 1 or 0” system compares with today’s 2025 Form W-4, particularly for married taxpayers filing jointly who both work. This will help you understand how the form changed—and how to set up accurate tax withholding under the new rules.

The Old Way: Guessing Between “1” and “0”

Before 2020, many dual-income couples tried to “split the difference” by having one spouse claim 1 allowance and the other claim 0. The goal was to balance tax withholding so that one spouse withheld less and the other withheld more to avoid either a large refund or an unexpected bill.

Here’s how that used to play out:

Scenario | Old W-4 System | Outcome |

|---|---|---|

Spouse A claims 1, Spouse B claims 0 | Spouse A’s pay had less tax withheld; Spouse B’s had more withheld | Take-home pay was higher overall, but they often owed taxes when filing jointly |

Both claim 0 | Each paycheck had extra tax withheld | Refund was larger, but paychecks were smaller throughout the year |

Both claim 1 | Each withheld too little | Often resulted in an unexpected tax bill and possible underpayment penalty |

Problem: This method relied on guesswork. Each employer calculated withholding as if that person’s income was the only one, so couples with two jobs often didn’t have enough withheld, especially if both earned similar salaries. The result? A surprise tax bill or even an underpayment penalty in April.

The New Way: The 2025 W-4 System for Married Couples

The redesigned IRS Form W-4 eliminates allowances completely. Instead, it uses your real financial situation—income, dependents, and other factors—to calculate how much federal income tax to withhold. This approach is more accurate and personalized for married couples filing jointly.

Here’s how a typical dual-income couple might use the 2025 Form W-4 to balance withholding.

Example: Emily and Jordan — Married, Both Work

- Emily earns $70,000

- Jordan earns $60,000

- They’re filing Married Filing Jointly

- They have two children eligible for the Child Tax Credit

Here’s how their setup might look under both systems:

Scenario | Old “1 or 0” System | New 2025 W-4 System |

|---|---|---|

Emily claims 1, Jordan claims 0 | Each paycheck was calculated separately; they often underpaid by ~$1,200 and owed taxes at filing | Both check Step 2 (“Multiple Jobs”) and claim dependents in Step 3; withholdings now reflect total income → balanced withholding |

Both claim 0 | Over-withholding created ~$2,000 refund but lower monthly income | With dependents listed in Step 3, the IRS estimator shows the right withholding → steady take-home pay + accurate refund |

Both claim 1 | Insufficient tax withholding → balance due + possible underpayment penalty | Not applicable; dependents and multiple jobs handled automatically via Steps 2 & 3 |

Why It Matters

For couples wondering whether to claim 1 or 0, the answer is simple. Your tax withholding as a married couple now depends on your total household income rather than individual earnings. With the 2025 W-4:

- You no longer “claim” a number; you enter real data instead.

- The IRS calculates your federal taxes more precisely.

- You can use the IRS Withholding Estimator to test scenarios and avoid too little tax withheld.

This system helps you strike the perfect balance between a comfortable take-home pay and a manageable tax refund—no more guessing, no more April surprises when you file your tax return.

Smart W-4 Tips for Married Filing Jointly

- Use the IRS Withholding Estimator each year to stay on track.

- If both spouses work, complete Step 2 (‘Multiple Jobs or Spouse Works’) on the 2025 Form W-4 or use the IRS Tax Withholding Estimator to help balance your household withholding.

- Add extra on Line 4(c) if your total income bumps you into a higher tax bracket.

- Update your W-4 after significant life changes, such as a new job, a new dependent, or a raise.

See how your combined income affects your tax refund and how to calculate your federal income taxes.

Source: IRS Form W-4

Final Thoughts: Updating Your W-4 the Right Way

If you’re still asking yourself, “Should I claim 1 or 0 if married?”, the answer is simple — neither. The IRS no longer uses allowances to calculate your federal income tax withholding. Instead, the modern Form W-4 focuses on your household’s real financial details: income, dependents, and adjustments.

For married couples filing jointly, this updated system makes it easier to match what’s withheld from your paycheck to what you’ll actually owe at tax time. No more guessing, no more overpaying, and no more April surprises.

Updating your W-4 takes just minutes and helps you avoid underpayment or giving the IRS an interest-free loan. Treat it as your yearly tax tune-up.

💡 Take Control of Your Withholding

Use the IRS Tax Withholding Estimator to see how your W-4 affects your paycheck and refund.

Then, file your joint return confidently with FileTax.com, your step-by-step guide to accurate and stress-free filing.

Other Categories

See what some of the hundreds of thousands of satisfied customers have to say about our services:

See what some of the hundreds of thousands of satisfied customers have to say about our services:

Levi C.

VERY FAST

VERY FAST

I got approved within a couple of days for my tax extension filing through these guys, and they responded to my email the same day. Great customer service and fast results. Give them a shot.

LaMontica

Great Service!!

Great Service!!

This is the second year that I have used this service. Each time, the process was quick, easy, and efficient. I will definitely be using this service in the future and will recommend it to friends and family.

Chezbie

Fantastic Site!!

Fantastic Site!!

The process was so easy. I processed this extension in a matter of minutes! For you last-minute filers out there, come here. It'll help you end your long day in peace!

File your tax extension today!

Get StartedFile your tax extension today!

Frequently Asked Questions

Frequently Asked Questions

No. The IRS replaced allowances with income, dependent, and adjustment entries starting in 2020. Learn more in IRS Pub 505.