Qualifying Surviving Spouse Requirements: Do You Qualify?

Your Takeaways:

- Qualifying Surviving Spouse (QSS) lets you keep the tax benefits of Married Filing Jointly for up to two years after your spouse’s death.

- You must have a qualifying dependent child, pay more than half of household costs, and not remarry during the tax year.

- QSS provides a higher standard deduction and more favorable tax brackets than Single or Head of Household.

- The status is temporary: after two years, you’ll switch to Head of Household (if eligible) or Single.

You may qualify as a Qualifying Surviving Spouse (QSS) for up to two tax years following the year of your spouse's death. The core requirements are: having a qualifying dependent child, paying over half the household expenses, and being eligible to file jointly in the year your spouse died.

This filing status allows a surviving spouse to keep the favorable tax benefits of Married Filing Jointly (such as a higher standard deduction and lower tax rates) during the transition period after a spouse's passing.

This guide walks through each requirement, offers clear examples, and shows you how to confirm your eligibility step by step.

This filing status is sometimes called Qualifying Widow or Widower with a dependent child. It can reduce your taxable income, unlock favorable tax brackets, and preserve tax benefits when financial stability matters most.

Introduction to the Qualifying Surviving Spouse Filing Status

The IRS created the Qualifying Surviving Spouse (QSS) filing status to help surviving spouses maintain the tax benefits they relied on while married. If you qualify, your tax return uses the same tax benefits as the married filing jointly status. That can mean a higher standard deduction, lower tax rates, and access to credits such as the child tax credit.

The catch is the timing. You can use this Qualifying Surviving Spouse filing status for up to two years after your spouse died. To qualify, you also need a dependent child and must meet several IRS eligibility rules. Think of QSS as a transitional status designed to cushion your finances while you rebuild. And yes, it is more generous than filing as Head of Household or Single.

What are the Full IRS Requirements for Qualifying Surviving Spouse Status?

Below is the full list of IRS rules you must meet. After each requirement, you will find short examples to make the eligibility rules easier to understand.

Requirement 1: You must have been eligible to file jointly

The Internal Revenue Service (IRS) provision applies if you were qualified to submit a joint return with your spouse during the tax year of their death. It is sufficient to meet the eligibility criteria; you are not required to have actually filed the joint return.

Example

Even if your spouse passed away early in the year and you lived separately before their death, you may still meet the requirements if you satisfy the conditions for a joint return. Your ability to file as a Qualifying Surviving Spouse depends on whether you were eligible to file a joint return with your spouse for the year they died, regardless of whether you filed jointly or not.

Source: IRS Pub. 501, Qualifying Surviving Spouse

Requirement 2: You must not remarry during the tax year

If you get married again at any time during the tax year, you forfeit the status of Qualifying Surviving Spouse for that year.

Example

Your spouse passed away in 2023.

If you remarry in 2024, you cannot use the Qualifying Surviving Spouse status for that year. Your tax filing status must reflect the new marriage.

Requirement 3: You must have a qualifying dependent child

This is one of the main requirements of the Qualifying Surviving Spouse status. Your child must satisfy the following tests to be considered a qualifying dependent:

- The child must be your child, stepchild, or adopted child (a foster child does not qualify).

- The child must live with you for more than half the tax year, except for temporary absences.

- Temporary absences include time spent away for school, medical treatment, military service, or, in certain cases, for a kidnapped child.

- The child must not be claimed as a dependent on someone else's return.

- The child's gross income does not disqualify as long as they meet all qualifying child tests, including age, residency, relationship, and support rules.

Source: IRS Pub. 501, Qualifying Child Tests

For a full breakdown, see our Head of Household guide on dependency tests.

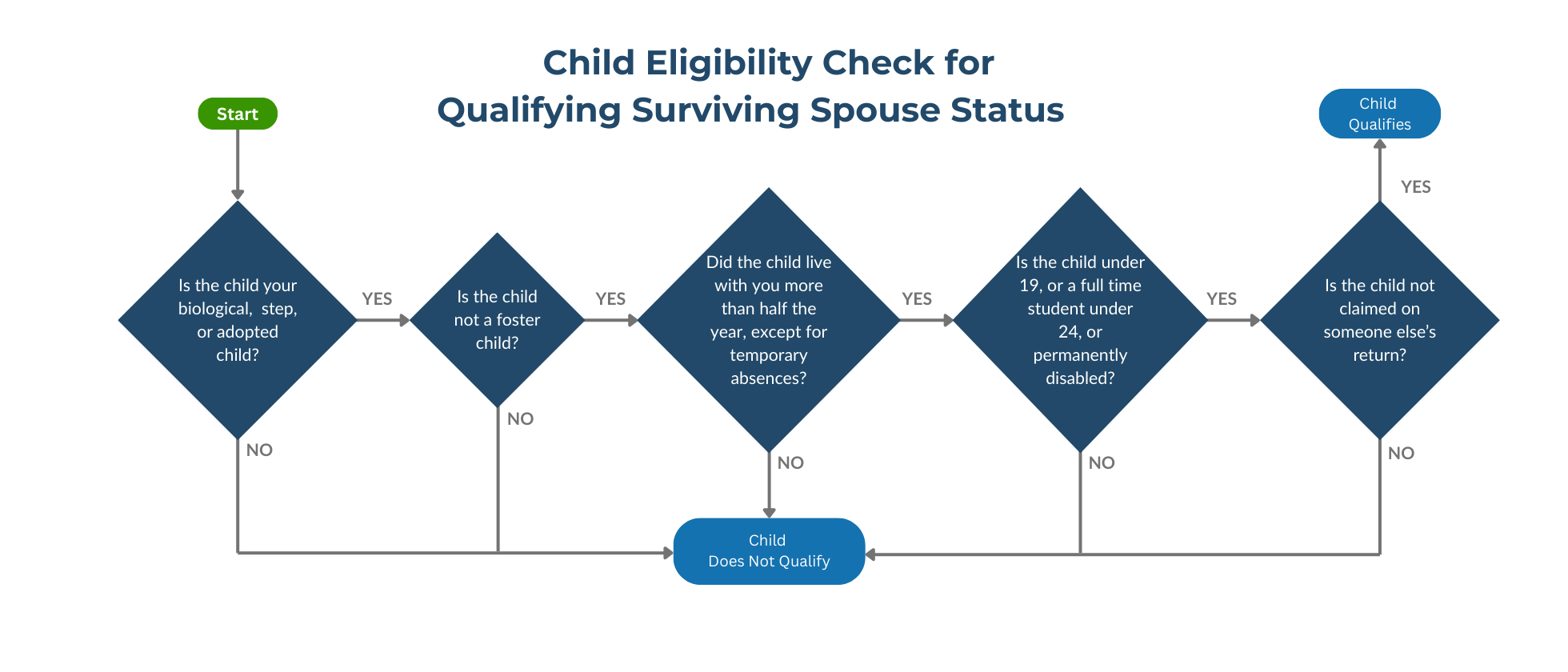

Dependency Child Decision Flowchart

One of the most important qualifying surviving spouse requirements is having a dependent child who meets the IRS criteria for this filing status. But figuring out whether a child actually qualifies can feel like decoding a secret IRS puzzle. To make this easier, we turned the rules into a simple flowchart you can follow step by step. This flowchart simplifies complex IRS rules into an easy decision path you can follow in under a minute.

This visual guide helps you confirm whether your child meets the residency test, relationship test, and the rules around temporary absences, joint returns, and who can claim the child. The goal is to give you clarity fast without diving into the full IRS dependency rulebook.

Requirement 4: You must pay more than half of household costs

You must pay more than half the cost of keeping up your main home for the year. Costs include mortgage interest, rent, property taxes, utilities, insurance, and food consumed in the home.

Costs like clothing, education, transportation, medical bills, and vacations do not count toward the support test.

Support Test Example Table

This simple example shows how the support test works.

Household Cost | Amount You Paid | Amount Others Paid |

|---|---|---|

Mortgage | $12,000 | $0 |

Utilities | $2,400 | $0 |

Food | $6,000 | $2,000 |

Property taxes | $3,000 | $0 |

Home insurance | $1,200 | $0 |

Your total paid: $24,600

Others paid: $2,000

You paid far more than half, so you pass.

Source: IRS Pub. 501, Keeping Up a Home

Requirement 5: You must meet the two year limit

You may use Qualifying Surviving Spouse status for the two tax years following the year your spouse died. After that, you switch to Head of Household or single unless you remarry.

Timeline Example

Your spouse died in 2023.

- 2023 tax year: You can file jointly.

- 2024 tax year: You can use QSS.

- 2025 tax year: You can use QSS.

- 2026 and beyond: You cannot use QSS.

Source: IRS Pub. 501, Qualifying Surviving Spouse

Additional IRS eligibility rules

The following rules apply even though taxpayers often overlook them:

- The child cannot file a joint return with someone else unless it is only to claim a refund.

- The child must live with you except for temporary absences.

- An adopted child is treated the same as a biological child for QSS purposes.

- A kidnapped child can still qualify if law enforcement presumes they will return.

- Your child can have taxable income and still qualify as long as they meet the qualifying child rules.

- Residency rules require you and the child to maintain your primary home.

Tax Benefits of Qualifying Surviving Spouse Status

When you qualify as a surviving spouse, your tax filing status entitles you to the same tax benefits as Married Filing Jointly. That includes the highest standard deduction amount available to individual taxpayers. While we avoid going into the mechanics of the standard deduction here, the benefit is substantial.

You also use the same tax brackets as Married Filing Jointly, which can significantly lower your taxable income compared to other filing statuses. That matters in a big way if you have property taxes, state taxes, or other deductible expenses. You may also qualify for the child tax credit and other benefits that depend on the presence of a qualifying dependent.

The idea is simple. You get nearly all of the tax benefits of marriage during the transition period after your spouse dies, so your financial life can stabilize.

QSS Eligibility Checklist

Use this checklist as a quick yes-or-no tool to confirm whether you meet the core QSS eligibility rules.

- You met the criteria to file a joint return with your deceased spouse for the tax year of their passing.

- You have not remarried by the end of the tax year.

- You have a dependent child, stepchild, or adopted child who lived with you more than half the year except for temporary absences.

- Your child is not a foster child.

- Your child was not claimed as a dependent on anyone else's return.

- You paid more than half the household costs.

- You meet the two year limitation on the surviving spouse status.

Filing Timeline After a Spouse’s Death

After your spouse passed, here is what your filing statuses look like:

- Year of death: You may file jointly status if you were eligible to file jointly.

- Next two years: You may claim the qualifying surviving spouse filing status if you meet the requirements.

- After that: You may qualify for head of household or, if no dependent, you file as single.

For details on the year of death filing, see the Death of a Spouse.

For HOH comparison rules, see the QSS vs HOH Guide.

Examples for Each Requirement

Example: If your spouse died early in the year

Your spouse passed away in February 2023. You were married all year except for temporary absences such as medical treatment. You can file jointly for 2023 and potentially claim the qualifying surviving spouse status for 2024 and 2025.

Example: If your child is a full time student

Your twenty-year-old child lives with you except while away at college. Temporary absences do not break residency. If the child meets the qualifying child rules, you may still qualify.

Example: If the child filed a joint return

Your child filed a joint return with their spouse only to receive a refund. They can still be your qualifying dependent.

Example: Foster child

If a child in your care is a foster child, they cannot satisfy the QSS child requirement. You may explore Head of Household instead.

Example: Remarriage timing

If you remarry in the same tax year you hope to claim QSS, you fail the eligibility rules. If you remarry the following year, eligibility ends that year.

Example: Shared household with adult sibling

If you and your adult sibling both contribute to household costs, you qualify only if your share exceeds 50 percent of total household expenses.

Final Thoughts

The qualifying surviving spouse requirements are strict but clear. If you meet the rules for a dependent child, the support test, and the two year limit, you may access the same tax benefits you enjoyed while married. This tax filing status can bring financial stability when you need it most.

If you want help figuring out whether you qualify or want a second set of eyes on your tax return, FileTax.com is here to make taxes feel human. And if you are comparing this status with head of household, check out our dedicated QSS vs HOH guide for the full breakdown.

Other Categories

See what some of the hundreds of thousands of satisfied customers have to say about our services:

See what some of the hundreds of thousands of satisfied customers have to say about our services:

Levi C.

VERY FAST

VERY FAST

I got approved within a couple of days for my tax extension filing through these guys, and they responded to my email the same day. Great customer service and fast results. Give them a shot.

LaMontica

Great Service!!

Great Service!!

This is the second year that I have used this service. Each time, the process was quick, easy, and efficient. I will definitely be using this service in the future and will recommend it to friends and family.

Chezbie

Fantastic Site!!

Fantastic Site!!

The process was so easy. I processed this extension in a matter of minutes! For you last-minute filers out there, come here. It'll help you end your long day in peace!

File your tax extension today!

Get StartedFile your tax extension today!

Frequently Asked Questions

Frequently Asked Questions

No. A qualifying dependent child is strictly required to claim the Qualifying Surviving Spouse filing status.