First Time Homebuyer Tax Credits and Programs

Your Takeaways:

- There is currently no active federal first-time homebuyer tax credit.

- New federal homebuyer credits have been proposed, but not yet passed.

- Many state and local programs offer down payment and closing cost assistance.

- Mortgage Credit Certificates (MCCs) can reduce taxes every year you own the home.

- MCCs provide a nonrefundable tax credit based on mortgage interest paid.

While the original federal homebuyer credit is no longer available, new proposals for 2025 and various state programs continue to provide tax relief for first-time buyers. Discover how these credits function, who qualifies, and how FileTax makes it easy to claim eligible programs when you’re filing your return.

Buying your home is a huge milestone, and it’s probably one of the biggest purchases you’ll ever make. It’s exciting, a little nerve-wracking, and definitely a moment you’ll remember forever.

But let’s be honest: purchasing a home can also hit your wallet hard. Between the down payment, closing costs, property taxes, and all the random expenses that pop up, the financial burden is real for most buyers.

The good news is that there are first time homebuyer tax credits, down payment assistance, and a host of other programs out there designed to help ease those costs and support homebuyers just like you.

You might have heard the whispers about these programs: the first time homebuyer tax credit, a mortgage credit certificate, or other forms of assistance that promise extra money back during tax season. Maybe your lender has mentioned tax deductions for mortgage interest, down payment support from your state, or even tax credits that reduce what you owe in federal taxes.

All these things sound great, but what do they actually do, and do you really qualify as a first-time homebuyer? We’re here to answer every question you might have, show you some examples, and help you claim every single refund, credit, and tax deduction you might be eligible for on the path to homeownership.

Whether you're just curious, saving up for your first home’s purchase price, or starting the pre-approval process for conventional loans or even USDA loans, there’s plenty you can learn here about how to boost housing affordability and make your first home a reality.

What Is the First-Time Homebuyer Credit?

Simply put, a first time homebuyer tax credit is a federal or state program that provides you with a tax reduction, direct tax credit, or even a refund to help qualifying buyers with their home purchase. In short, these credits are meant to make homeownership more affordable, especially with today’s median home prices squeezing so many first-time buyers.

Many homebuyers are surprised to learn that, while the original federal tax credit (which once handed out thousands of dollars) ended over a decade ago, there are new proposals and active state homebuyer programs that can help you cover your down payment, offset your closing costs, or lower your federal taxes on your tax return each year.

For example, some programs offer a refundable tax credit, while others give you a nonrefundable tax credit, meaning it only reduces what you owe but doesn’t provide a refund if your federal tax bill is already zero.

Definition: The first time homebuyer credit is a federal or state tax benefit designed to make buying a first home more affordable through direct tax credits or down payment assistance. These programs support first time homebuyers, single parents, and families dealing with high median home prices or a limited income. |

|---|

And while the original homebuyer tax credit has ended, lawmakers have proposed new federal tax credits in recent years. States never stopped offering these, for the most part, with many offering year-round help through down payment assistance grants, mortgage credit certificates (MCCs), and other homebuyer tax credit programs.

You can learn more about whether buying a house helps your taxes here, but the most reliable source for updates on available programs is via the IRS Newsroom or through the Department of Housing and Urban Development.

The Original Federal Credit (2008–2010)

To understand the current state of first-time homebuyer tax credits, it helps to rewind a bit and go back in history.

After the 2008 financial crisis, housing affordability looked bleak and homeownership rates were falling fast. The federal first time homebuyer tax credit gave up to $8,000 in refundable tax credits for eligible buyers. The government’s goal was to support home builders, encourage first time homebuyers, and get families into a primary residence, even when the business of buying a house felt out of reach.

Example: If you bought a home in 2009, for example, you could claim up to $8,000 in refundable tax credits on your tax return. That was a full credit against your federal tax bill. Even if your tax owed was lower than $8,000, you’d receive a refund for the difference, reducing your taxable income and making your home’s purchase price easier to bear. |

|---|

This time homebuyer tax credit was a lifesaver for many buyers who needed help with their first home purchase or who were limited by their taxable income. However, it was always only meant to be temporary. As the housing market rebounded and more buyers returned, the credit wound down.

By 2010, the last wave of buyers claimed it, and today there’s no active federal tax credit like this for your 2025 tax return, even though some former recipients are still repaying what was once, for them, an interest-free loan.

Proposed Federal Programs for 2025

Now, let’s look ahead to what might be coming down the pike.

Housing affordability is back in the headlines once more, with median home prices rising and first-time buyers facing stiff competition. Lawmakers in Washington, D.C. are working on ways to help with new first time homebuyer tax credit programs and other forms of assistance, with three main proposals on the table as of November 2025.

First, the First Time Homebuyer Act of 2025 would create a new federal tax credit worth up to $15,000 for eligible first-time buyers. This would be a refundable tax credit, if it passes, so you could receive a refund for the full credit even if your federal taxes owed are less than $15,000.

The second is the Downpayment Toward Equity Act, which aims to provide up to $25,000 in assistance for first-generation buyers. The program would give even more money to those without a family history of homeownership and could go a long way toward helping with your closing costs or initial down payment.

Another important bill to note is H.R.3475, the Bipartisan American Homeownership Opportunity Act of 2025. Introduced in the House in May of 2025 and awaiting legislative approval, this bill provides a refundable tax credit to first-time homebuyers as well as one for home builders of starter homes. If it passes, first-time buyers may be able to claim tax credits equal to the amount of the down payment up to $50,000 (subject to income restrictions).

All of these proposals, though not yet passed, are meant to help families manage that steep upfront payment and make homeownership possible even when median home prices seem out of reach.

Since these programs aren’t yet inked into Law, FileTax remains committed to offering specific guidance and updates if Congress enacts either one before the April 15, 2026 filing deadline. You can also check the IRS Newsroom and CBO for legislative summaries and more federal tax credit news.

State-Level Homebuyer Credits and Assistance Programs

If you don’t want to wait around for Congress to start saving money (who does?) The good news is that you’ve got options. Almost every state already offers some kind of support to first-time homebuyers, from downpayment grants that offset the cost of your home’s purchase price to mortgage credit certificates to programs that make your new property more affordable at tax season.

Here’s a snapshot of how a few states are pitching in to help first time homebuyers and boost housing affordability:

State | Program Name | Benefit |

|---|---|---|

California | CalHFA MyHome | Deferred-payment junior loan for up to 3.5% of your home’s purchase price, letting you delay a big payment. |

Iowa | FirstHome Program | Grants to help families and single parents with down payments and closing costs. |

Texas | My First Texas Home | Mortgage credit certificate (MCC) worth up to $2,000 per year as a nonrefundable tax credit on federal taxes. |

New York | SONYMA DPA Loan | Up to $15,000 available for a down payment or closing costs. |

Remember, your eligibility for these homebuyer programs varies by income, home’s purchase price, whether you’re a first time or first-generation buyer, and sometimes even your spouse’s ownership history.

Some programs go one step further, requiring that the home is a permanent structure or a primary residence. For more about state programs, see this page or with your state housing authority for the best advice.

Mortgage Credit Certificates (MCCs)

Mortgage credit certificates are a favorite for crafty first-time buyers using conventional loans, some Fannie Mae programs, or even USDA loans. If you’re approved for an MCC, you can claim a nonrefundable tax credit each tax season for a portion of your mortgage interest, lowering your federal tax bill for as long as you keep your home and loan.

Example: Say your MCC rate is 20%. If you pay $8,000 in mortgage interest this year, you’re eligible to claim a $1,600 nonrefundable tax credit. That comes straight off your federal taxes owed. Plus, you still get to claim the remaining $6,400 as a regular mortgage interest deduction! |

|---|

The only catch is that the MCC credit is nonrefundable; it can reduce your federal bill to zero, but you won’t get extra money back beyond what you owe.

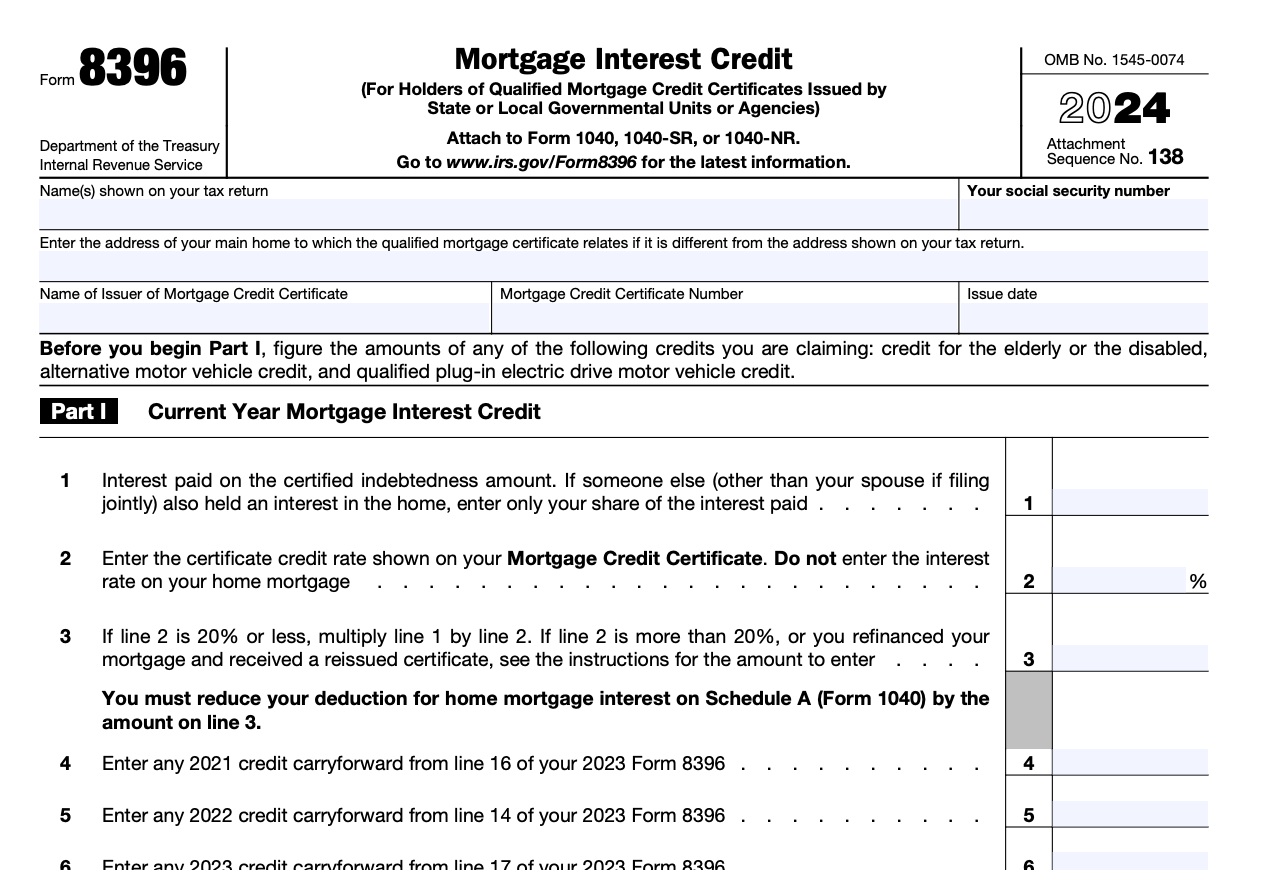

You claim the MCC every year using IRS Form 8396 (the classic for any mortgage interest

credit). State housing authorities or your lender can help you with the specifics or give you an approval certificate to include with your tax filing.

Who Qualifies as a First-Time Homebuyer?

The IRS and HUD have a pretty generous definition of a first time homebuyer, making these credits easier to access than you might think. In general, you’re considered a first-time homebuyer if you haven’t owned a primary residence or property during the past three years before your new home purchase.

There are also some exceptions to IRS and HUD programs and their rules, though. Say you’re a single parent or you recently divorced a former spouse and haven’t owned a home since. In either of these cases, you may be able to re-qualify.

Likewise, many first time home buyer tax credit programs make extra allowances for veterans or first-generation homebuyers (even if your spouse owned before), so exceptions apply. If you sold your home in 2020 and have rented since, you could again become eligible as a first time homebuyer in 2025.

For more, check out our guides on divorce and taxes or how buying a house affects your taxes.

How to Claim a Homebuyer Credit or Deduction

If you’re ready to claim your homebuyer tax credit, down payment assistance, or mortgage interest deduction, here’s what you need to do:

- Make sure you're eligible: Contact your lender, your state’s housing authority, or check HUD’s website for most current requirements. Your eligibility may be affected by income, home purchase price, former property ownership, or other criteria.

- Get your paperwork: This means MCC certificates, state loan approval letters, or proof of down payment assistance.

- Fill out the right forms: For an MCC, complete IRS Form 8396 (mortgage interest credit), and for other credits, check your program’s specific guidance.

- File your federal taxes: Attach your documentation and forms to your tax return. Programs like FileTax can handle most of this for you and will automatically check for eligible credits, making tax season a little less stressful.

Remember, most federal tax credits must be claimed by April 15, 2026, for the 2025 tax year. And if you’re wondering how these credits work alongside grants or other programs, your tax preparer or lender can give specific advice.

Recordkeeping and Documentation

Keeping reliable records for filing your taxes is always important, but if you’re claiming a first-time homebuyer tax credit, an MCC, or any other homebuyer program benefit, then it’s doubly so. Digital copies are often accepted for these documents:

- Closing Disclosure, HUD-1 Settlement Statement, or sale paperwork

- State approval letters or your MCC certificate

- Proof of first time homebuyer status (rental history, an affidavit, or support docs from your lender)

Need help getting organized? Use FileTax.com’s secure document manager, which can help you keep everything in one tidy spot, year after year.

Don’t Leave Money on the Table

Buying your first home comes with plenty of paperwork and a few nerves, but there’s still good news when it comes to taxes. While there’s currently no federal first-time homebuyer tax credit, many first-time buyers can still unlock meaningful tax savings through other benefits.

Mortgage interest deductions, state and local property tax deductions, and energy efficiency tax credits can all reduce your taxable income. In particular, energy-efficient home improvements may qualify for credits worth up to $3,200 in 2025, making them one of the most valuable opportunities available to new homeowners.

Tax rules and incentives change often, so staying up to date is key to making sure you don’t miss out on deductions or credits you’re eligible for. You’ve worked hard to buy your first home, now make sure your tax return works just as hard for you.

💡 File your taxes with confidence. FileTax.com automatically checks for available homebuyer credits and applies them to your return.

Other Categories

See what some of the hundreds of thousands of satisfied customers have to say about our services:

See what some of the hundreds of thousands of satisfied customers have to say about our services:

Levi C.

VERY FAST

VERY FAST

I got approved within a couple of days for my tax extension filing through these guys, and they responded to my email the same day. Great customer service and fast results. Give them a shot.

LaMontica

Great Service!!

Great Service!!

This is the second year that I have used this service. Each time, the process was quick, easy, and efficient. I will definitely be using this service in the future and will recommend it to friends and family.

Chezbie

Fantastic Site!!

Fantastic Site!!

The process was so easy. I processed this extension in a matter of minutes! For you last-minute filers out there, come here. It'll help you end your long day in peace!

File your tax extension today!

Get StartedFile your tax extension today!

Frequently Asked Question

Frequently Asked Question

Not yet! The First-Time Homebuyer Act of 2025 is proposed, but not law. As a new homeowner, (LINK - /tax-benefits-owning-home), you may qualify for state-level programs, MCCs, or grants instead.